Tesla's Q2 Deliveries Exceed Expectations: A Live, Hot Issue in the Economy and Business World

Tesla, the leading electric vehicle manufacturer, has recently reported its Q2 delivery numbers, which have exceeded market expectations. This live, hot issue in the economy and business world is set to impact the stock market and the overall state of the EV industry.

Table of Contents

- 📈 Tesla's Q2 Delivery Numbers Surpass Expectations

- 🇨🇳 Tesla's China Sales and Industry Comparison

- 📊 Analysts' Expectations for Tesla's Annual Sales

- 🚀 Upcoming Milestones for Tesla Investors

- 🤖 Tesla's Robotaxi Plans and Investor Focus

- 📈 The Impact of Tesla's Q2 Delivery Surge

- 🏭 Tesla's Production Figures and Efficiency

- 🔍 Comparing Tesla's Sales to BYD and Other Automakers

- 📊 Analysts' Reactions and Potential Revisions

- 🤖 The Significance of Tesla's Robotaxi Announcement

📈 Tesla's Q2 Delivery Numbers Surpass Expectations

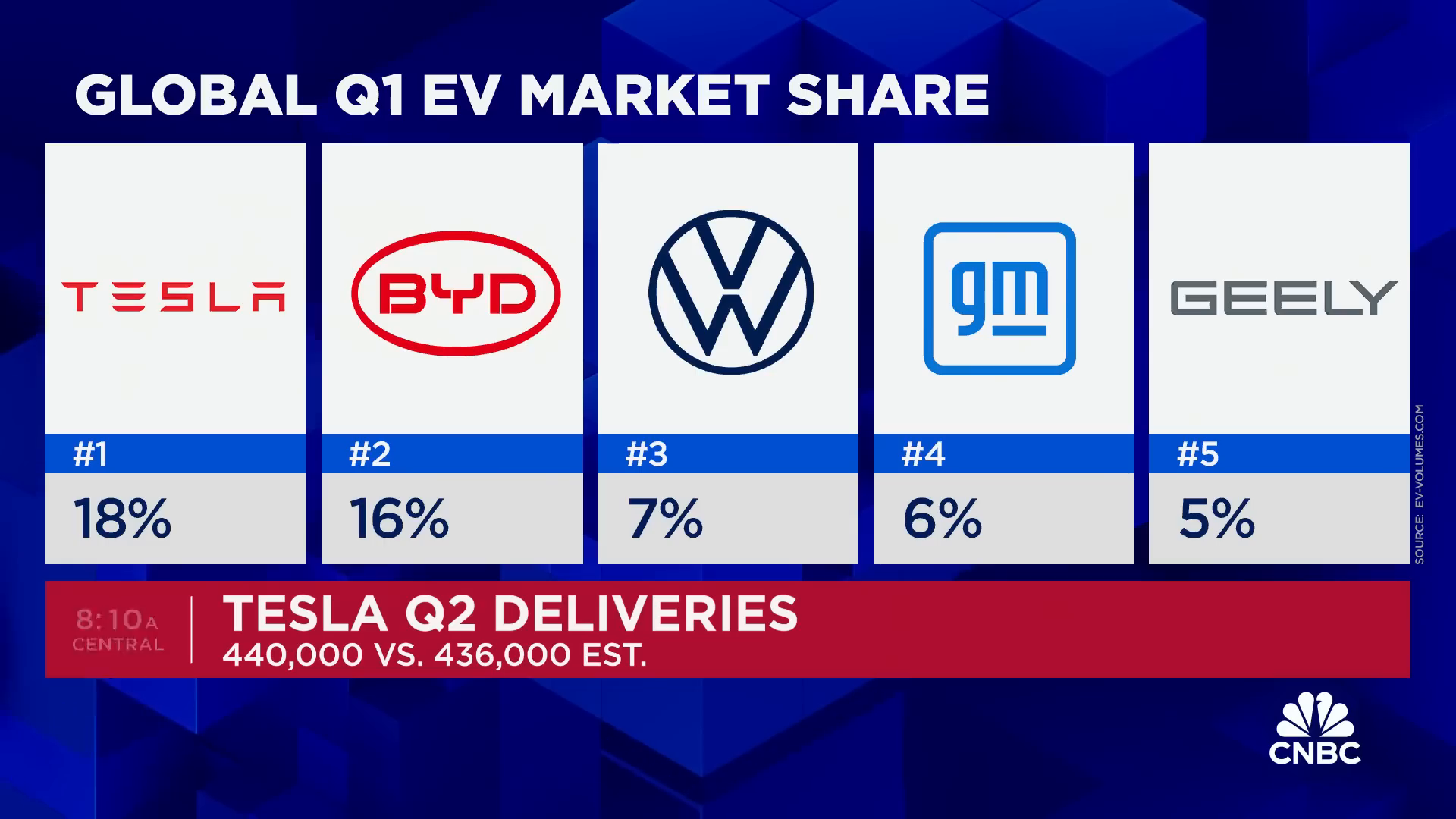

Breaking news on Tesla! The Q2 delivery numbers for Tesla have exceeded market expectations, showcasing a robust performance that is set to impact the stock market and the overall state of the EV industry. The street was expecting around 436,000 vehicles to be delivered worldwide in the second quarter, but Tesla surpassed this with an impressive 443,956 vehicles delivered.

Tesla's Q2 Delivery Numbers

Tesla delivered 443,956 vehicles in the second quarter, surpassing the market's expectations. This includes 95% of Model 3 and Model Y vehicles, highlighting the strong demand for these models in the market.

Tesla's Q2 Production Figures

Production for the second quarter stood at 410,831 vehicles, further indicating Tesla's strong operational performance during this period.

🇨🇳 Tesla's China Sales and Industry Comparison

Earlier today, Tesla's China sales figures were released, sparking some concerns in the market. China, being the world's largest EV market, plays a crucial role in Tesla's overall sales worldwide. Understanding Tesla's performance in China and comparing it to industry peers is essential in analyzing its global positioning and market competitiveness.

Tesla's Performance in China

In June, Tesla's sales in China totaled 71,007 vehicles, reflecting a 24% decline year over year. In the second quarter, Tesla delivered a little over 200,000 vehicles in China, signifying its substantial presence in the region's EV market.

Industry Comparison: Tesla vs. BYD

Comparing Tesla's performance in China to that of industry peers provides valuable insights. BYD, a prominent player in the EV market, reported first-quarter sales of 426,000 pure electric vehicles, presenting a reference point for evaluating Tesla's position in the Chinese market.

📊 Analysts' Expectations for Tesla's Annual Sales

Analysts are closely monitoring Tesla's annual sales expectations, particularly in light of the company's strong Q2 delivery performance. Currently, analysts anticipate approximately 1.82 million vehicles to be delivered by Tesla for the full year, which is a marginal increase from the 1.81 million vehicles delivered last year, indicating a relatively stable performance.

Market Expectations

The market is keen on observing whether the robust Q2 deliveries will influence analysts to revise their full-year delivery estimates. There is a possibility that the positive momentum witnessed in Q2 could prompt analysts to consider raising the annual delivery forecast, reflecting the potential impact of Tesla's performance on the stock market and the broader EV industry.

Upcoming Q2 Results

The upcoming Q2 results, scheduled to be released on July 23rd, will provide crucial insights into the impact of pricing in China on Tesla's performance. This data will be pivotal in shaping analysts' perspectives on the company's annual sales trajectory and its implications for investors and the stock market.

🚀 Upcoming Milestones for Tesla Investors

Tesla investors are eagerly anticipating key milestones that will shape the company's trajectory and influence investment decisions. As the electric vehicle industry continues to evolve, staying informed about these upcoming developments is essential for investors to make well-informed decisions.

July 23rd: Q2 Results

On July 23rd, after the bell, Tesla will release its Q2 results, providing comprehensive insights into the company's performance during this period. Investors will closely analyze these results to gauge the impact of pricing in China on Q2 outcomes and assess the implications for their investment strategies.

🤖 Tesla's Robotaxi Plans and Investor Focus

As Tesla's Q2 delivery numbers exceed expectations, the focus shifts to its ambitious plans for a robotaxi network. The company aims to leverage its autonomous driving technology to create a fleet of self-driving vehicles for ride-sharing services. This innovative initiative has captured the attention of investors and industry experts, signaling a potential transformative shift in the transportation sector.

Tesla's Robotaxi Network

Tesla's vision for a robotaxi network involves deploying fully autonomous vehicles that can operate as ride-sharing platforms, offering convenient and cost-effective transportation solutions. This disruptive concept has the potential to revolutionize the way people commute and has garnered significant interest from investors looking to capitalize on the future of mobility.

Investor Interest

Investors are closely monitoring Tesla's progress in developing its robotaxi network, recognizing the potential for substantial long-term returns. The successful implementation of this initiative could significantly impact Tesla's valuation and solidify its position as a leader in the autonomous driving space, making it a key consideration for investors evaluating the company's growth prospects.

📈 The Impact of Tesla's Q2 Delivery Surge

Tesla's remarkable surge in Q2 deliveries has reverberated throughout the stock market and the broader economy, sparking discussions about its implications for the EV industry and beyond. The company's ability to surpass delivery expectations has not only bolstered its position in the market but has also raised intriguing questions about the future trajectory of the electric vehicle sector.

Stock Market Response

The robust Q2 delivery performance has elicited a positive response from the stock market, with Tesla's stock witnessing notable fluctuations in response to this development. This surge in deliveries has the potential to influence investor sentiment and contribute to shifts in the valuation of not only Tesla but also other companies operating in the EV space.

Industry Impact

Tesla's Q2 delivery surge is poised to have a far-reaching impact on the EV industry, potentially setting new benchmarks for competitors and stimulating further innovation and investment in electric vehicle technology. This surge underscores Tesla's ability to drive industry trends and steer the trajectory of the global automotive market, making it a pivotal development for stakeholders across the economy.

🏭 Tesla's Production Figures and Efficiency

Tesla's production figures for the second quarter have showcased impressive efficiency and operational performance, contributing to its better-than-expected delivery numbers. The company's robust production capabilities not only demonstrate its ability to meet market demands but also play a pivotal role in shaping its overall market positioning and investor sentiment.

Tesla's Q2 Production Figures

Tesla's production for the second quarter stood at an impressive 410,831 vehicles, surpassing market expectations. This efficient production capacity has not only bolstered the company's delivery performance but has also underscored its operational prowess in meeting global demand for electric vehicles.

🔍 Comparing Tesla's Sales to BYD and Other Automakers

Comparing Tesla's sales figures to those of prominent automakers, such as BYD, provides valuable insights into its competitive positioning and market performance. Understanding how Tesla fares in comparison to industry peers is essential in evaluating its market share, consumer demand, and global competitive standing.

Tesla's Performance in China

In June, Tesla's sales in China experienced a 24% decline year over year, totaling 71,007 vehicles. Additionally, the company delivered over 200,000 vehicles in China during the second quarter, reflecting its substantial presence in the region's EV market.

Industry Comparison: Tesla vs. BYD

BYD, a prominent player in the EV market, reported first-quarter sales of 426,000 pure electric vehicles, providing a comparative benchmark for evaluating Tesla's position in the Chinese market. This comparison offers valuable insights into Tesla's market share and competitive performance relative to established industry players like BYD.

📊 Analysts' Reactions and Potential Revisions

Analysts are closely monitoring Tesla's performance, contemplating potential revisions to the full-year delivery estimate as they observe positive momentum. The upcoming Q2 results on July 23rd will be pivotal in shaping analysts' perspectives and could prompt revisions in annual delivery forecasts, impacting the stock market and the broader EV industry.

Market Expectations

Analysts are evaluating the possibility of revising the full-year delivery estimate following Tesla's strong Q2 performance, reflecting the potential influence of the company's trajectory on market forecasts and investor sentiment.

Upcoming Milestone: Q2 Results

The Q2 results, scheduled for release on July 23rd, will provide crucial insights into the impact of pricing in China on Tesla's performance, potentially prompting analysts to revise their annual delivery forecast based on the observed market dynamics.

🤖 The Significance of Tesla's Robotaxi Announcement

Tesla's ambitious plans for a robotaxi network have captured substantial attention, signaling a potential transformative shift in the transportation sector. The company's vision for a fleet of self-driving vehicles for ride-sharing services has garnered significant interest from investors and industry experts, reflecting the potential for substantial long-term returns and a significant impact on Tesla's valuation.

Investor Interest

Investors are closely monitoring Tesla's progress in developing its robotaxi network, recognizing the potential for substantial long-term returns. The successful implementation of this initiative could significantly impact Tesla's valuation and solidify its position as a leader in the autonomous driving space, making it a key consideration for investors evaluating the company's growth prospects.

Made with VideoToBlog

Comments

Post a Comment