Live, Hot Issue: Q2 Wrap-Up and Outlook for July's Bullish Seasonality

- Get link

- X

- Other Apps

As we wrap up Q2 and head into the traditionally strong month of July, our expert market strategist Dave Keller breaks down the latest trends in the S&P 500, key growth stocks like Apple and Tesla, and the potential impact of rising interest rates on the economy and business sectors.

Table of Contents

- 📺 Intro

- 📈 Market Recap

- 📈 S&P 500 Large Cap Index ($SPX), S&P 500 Equal Weight ETF (RSP)

- 📈 10-Year US Treasury Yield ($TNX), Waste Management (WM)

- 📈 MGM Resorts International (MGM), Autozone (AZO)

- 📈 Carnival Corp. (CCL), Tesla (TSLA), Apple (AAPL)

- 📈 CrowdStrike Holdings (CRWD), Goldman Sachs (GS)

📺 Intro

Welcome to the world of live market analysis and insights! As a professional market strategist, I'm here to provide you with the latest updates on hot issues in the economy, business, and stock market. Join me as we delve into the key trends and developments that are shaping the financial landscape.

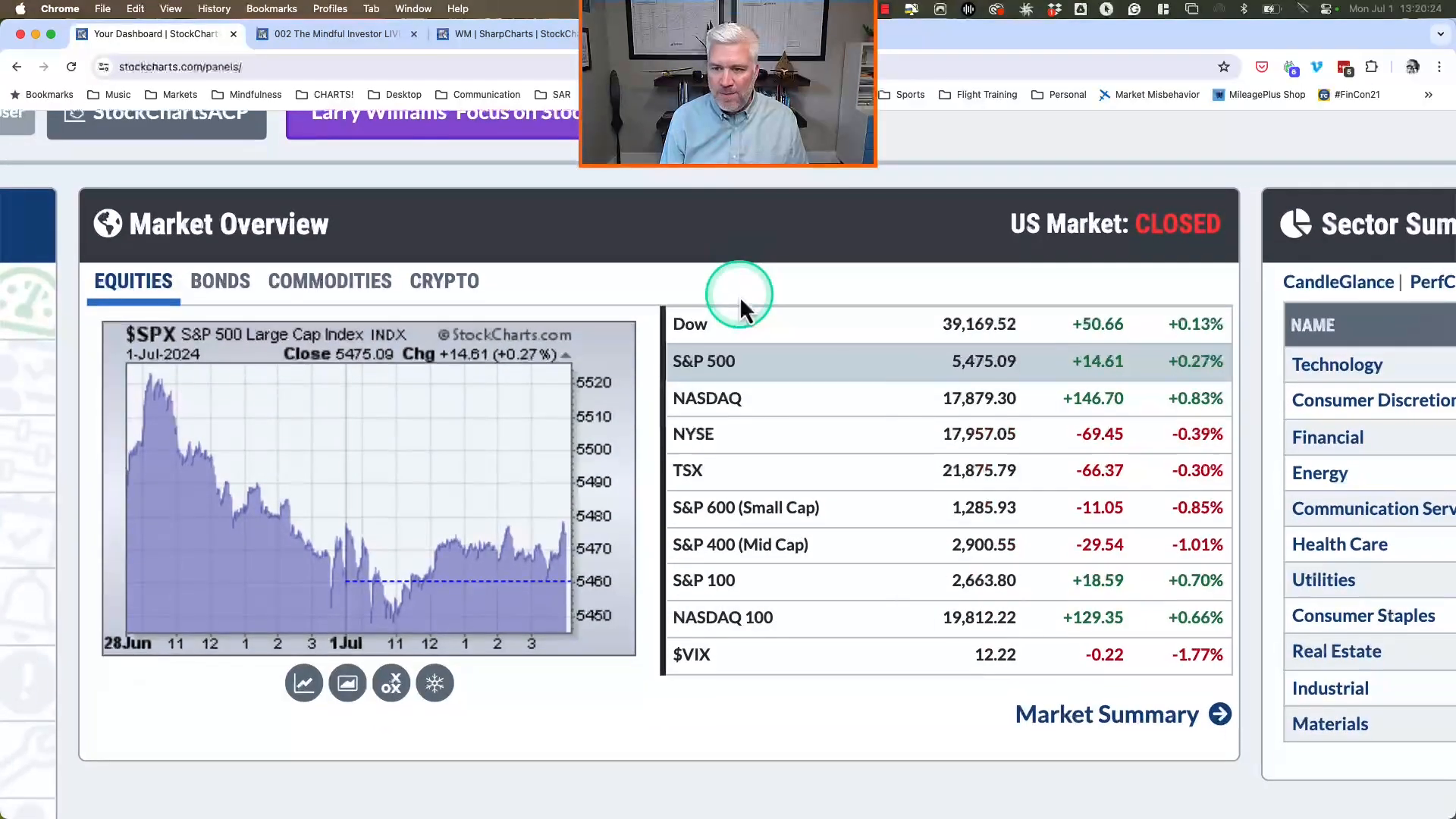

📈 Market Recap

Let's dive into a comprehensive market recap and focus on the evolution of the markets at the start of Q3 2024. The S&P 500 closed just above 5475, marking a quarter of a percent increase, while the NASDAQ composite surged by 8% from the previous day's close. However, midcaps and small caps experienced a decline, with the midcap S&P 400 being the worst performer, down approximately 1%. The VIX, indicating market volatility, remained just above 12, reflecting low uncertainty and strong market conditions.

S&P 500 Large Cap Index and S&P 500 Equal Weight ETF

The S&P 500 large cap index demonstrated a modest increase, while the S&P 500 equal weight ETF exhibited positive momentum.

10-Year US Treasury Yield and Waste Management

Long bond yields rose to around 4.64, with the 10-year yield hovering just below 4.50. Additionally, Waste Management experienced notable market activity.

MGM Resorts International, Autozone, and Carnival Corp.

MGM Resorts International and Autozone encountered significant market movements, while Carnival Corp. faced challenges, contributing to market shifts.

Tesla, Apple, CrowdStrike Holdings, and Goldman Sachs

Tesla and Apple emerged as top performers, while CrowdStrike Holdings and Goldman Sachs also played pivotal roles in the market landscape.

📈 S&P 500 Large Cap Index ($SPX), S&P 500 Equal Weight ETF (RSP)

When analyzing the S&P 500 large cap index, it's evident that the market has been range-bound, showing little movement over the past few weeks. Despite initial upward momentum, the index has largely remained between 5450 and 5500. This range-bound pattern has led to a decrease in volatility, as indicated by the low VIX in the low 12s. As a trend follower, I'm closely monitoring the key levels of 5400 and 5500. A break below 5400 would change my outlook, while surpassing 5500 would signal a positive shift with additional buyers pushing risk assets higher.

Seasonality View and Market Outlook

July historically demonstrates strength, with an average return of over 3% and a head rate of almost 90%. This strong performance is consistent with previous years, making it reasonable to expect a robust July. Additionally, considering the weakness typically observed in August and September, it's essential to anticipate a potential summer peak in July before a rotation lower in the following months. If a downward rotation occurs, Fibonacci analysis indicates a potential retest of the April low, aligning with historical market behavior.

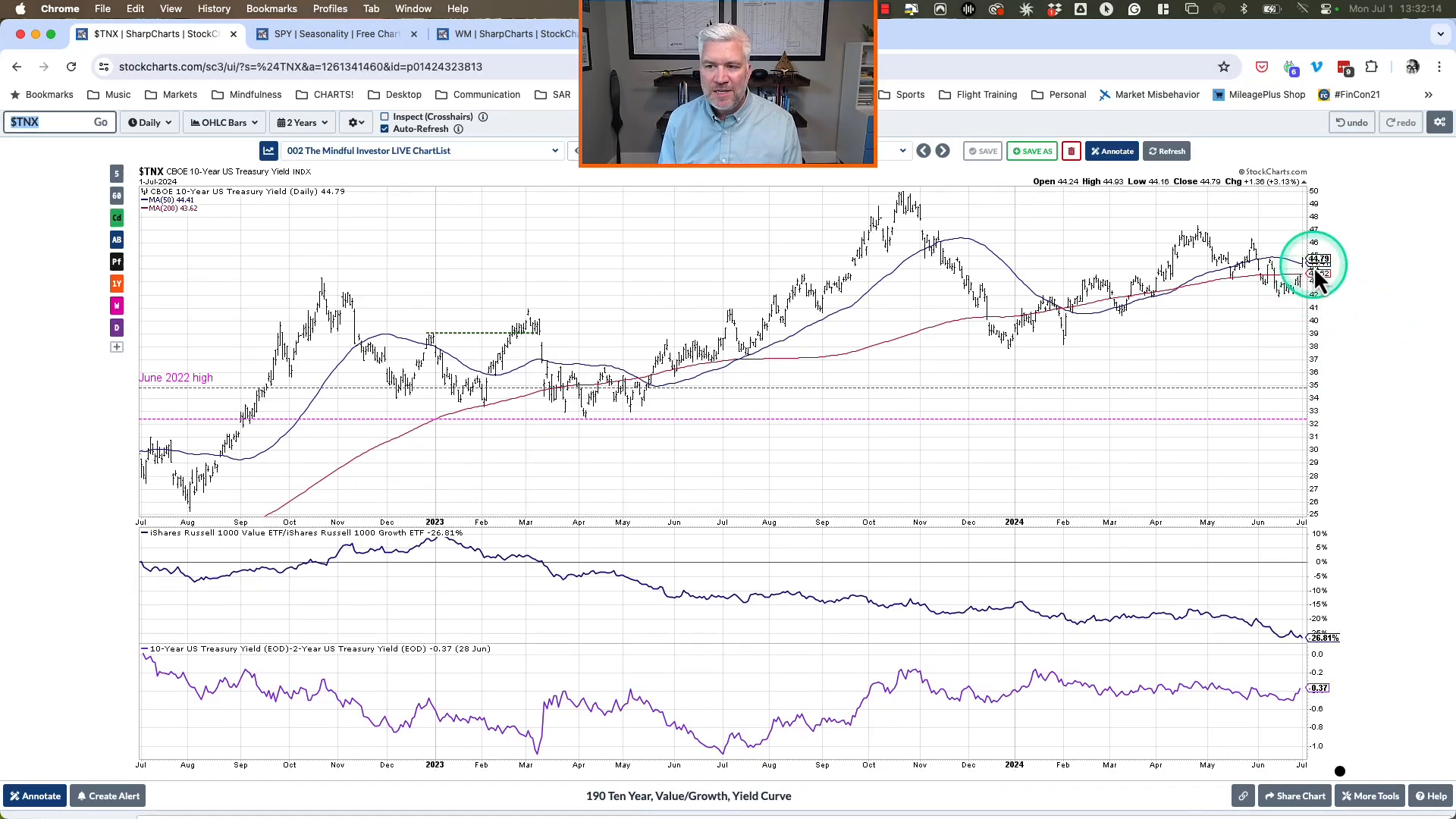

New Dow Theory and Market Breadth

Examining the new Dow Theory, it's noteworthy that the cap-weighted benchmarks, such as the S&P 500 and NASDAQ, reached new all-time highs in June. However, the equal-weighted S&P 500 and NASDAQ 100 made their all-time highs in March and have not surpassed these levels in the second quarter. This discrepancy in performance highlights potential market breadth concerns, emphasizing the need for a cautious approach. Furthermore, the percentage of stocks above their 50-day moving average has declined to around 42%, indicating a decrease in market breadth despite the overall positive performance of the S&P and NASDAQ.

Understanding these market dynamics and historical patterns is crucial for making informed investment decisions. For advanced financial charts and technical analysis tools to aid in your investment strategies, I recommend leveraging the resources available at StockCharts.com.

Stay informed, stay ahead, and trade smarter!

📈 10-Year US Treasury Yield ($TNX), Waste Management (WM)

Let's delve into the recent movements in the 10-Year US Treasury Yield and the notable activity surrounding Waste Management. These factors play a crucial role in shaping the current economic landscape and impacting various sectors of the business and stock markets.

10-Year US Treasury Yield ($TNX)

The 10-year yield has seen a notable uptick, reaching around 4.45% from the previous level of 4.35%. This surge has led to a testing of trend line resistance, indicating a potential shift in interest rates. The current downtrend channel, with clear resistance levels around 4.53%, suggests the possibility of further rate increases in the upcoming month. Such developments could significantly impact the market environment, potentially leading to a different scenario than the predominantly rate-decreasing trend observed in Q2. This shift in rates poses a potential risk to the current market dynamics, especially considering the prolonged outperformance of growth stocks in the recent period.

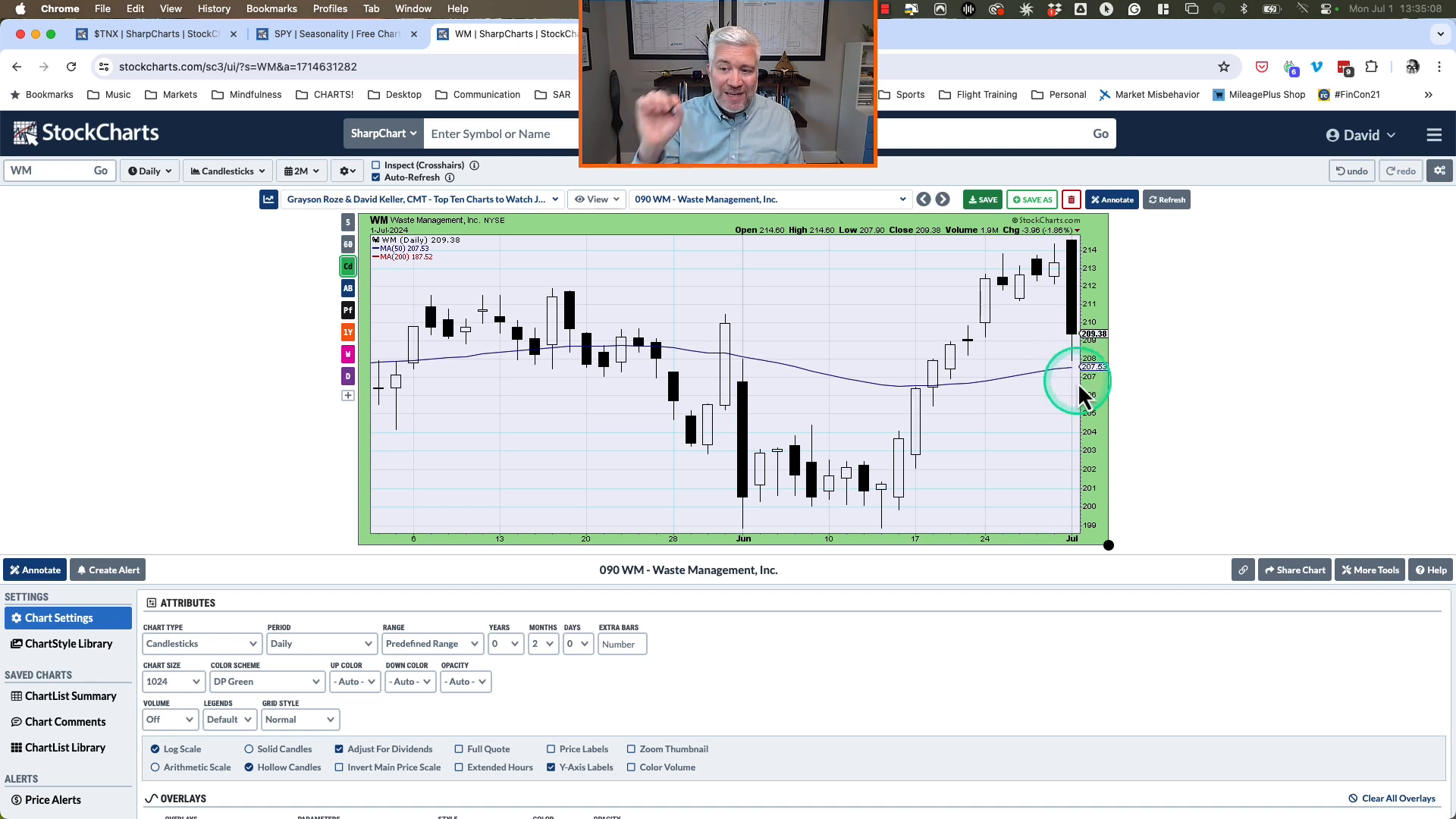

Waste Management (WM)

Waste Management has exhibited a bearish engulfing pattern, signaling a potential reversal in its market trajectory. This pattern is particularly significant as the stock is currently testing previous resistance levels, emphasizing the importance of monitoring its price action. While the bearish engulfing pattern typically provides insight into the next one to three bars, it serves as a cautionary indicator amid the testing of key resistance. This pattern suggests a potential pullback, highlighting the importance of observing the behavior around the 50-day moving average to assess the stock's future direction.

These developments in the 10-Year US Treasury Yield and Waste Management underscore the dynamic nature of the current market environment, requiring a diligent approach to navigate potential shifts in the economy and stock sectors.

📈 MGM Resorts International (MGM), Autozone (AZO)

Let's explore the recent market movements of MGM Resorts International and Autozone, shedding light on their impact on the economy and stock sectors.

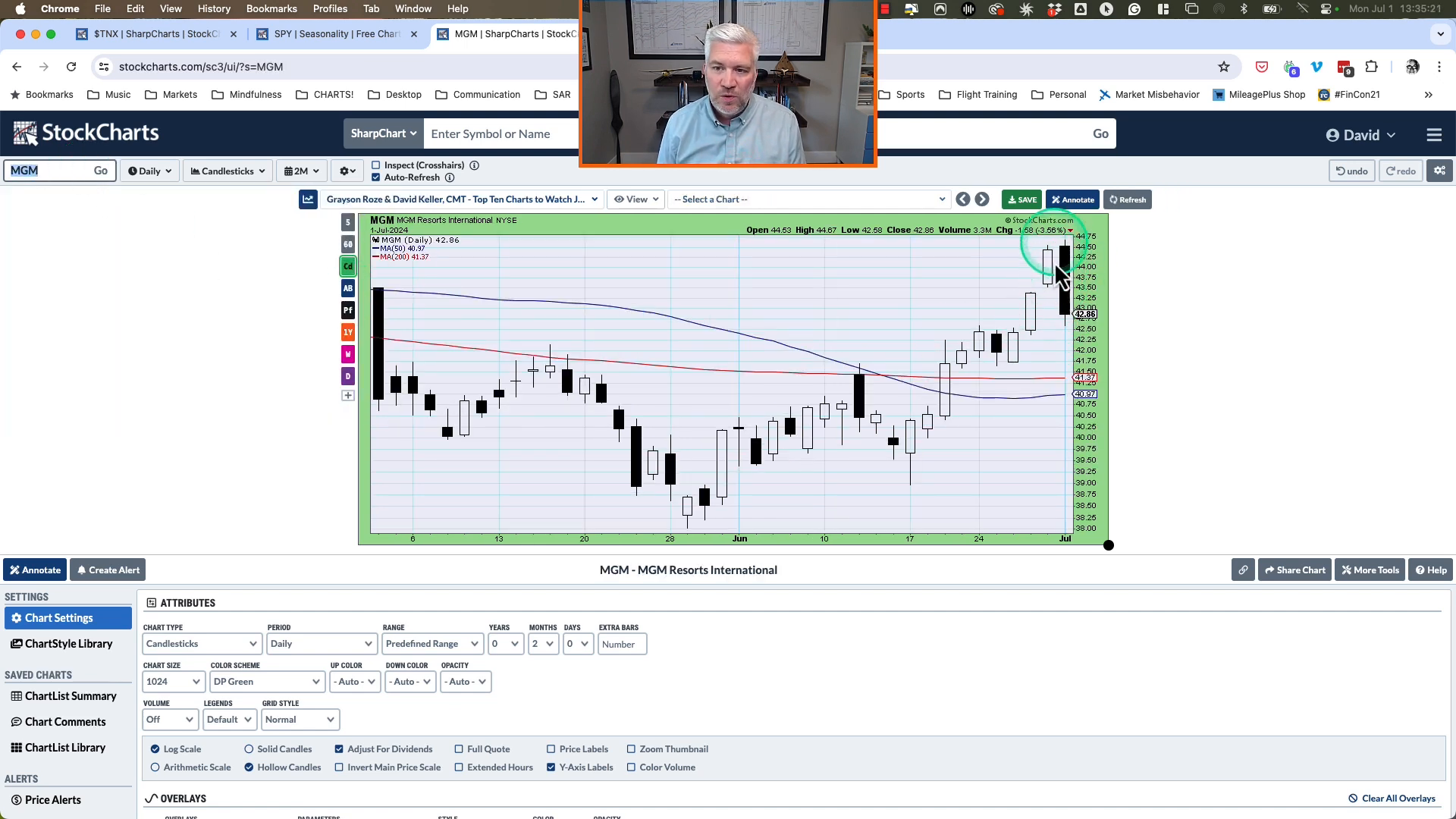

MGM Resorts International (MGM)

MGM Resorts International has exhibited a noteworthy bullish momentum divergence, with lower lows in May and higher lows in momentum. Following a higher low around 39, the stock experienced a rotation higher. However, recent market activity has revealed a short-term weakness, as indicated by a bearish engulfing pattern, signaling potential distribution after a period of being overbought. This pattern emphasizes the significance of closely monitoring MGM's price action and potential support levels.

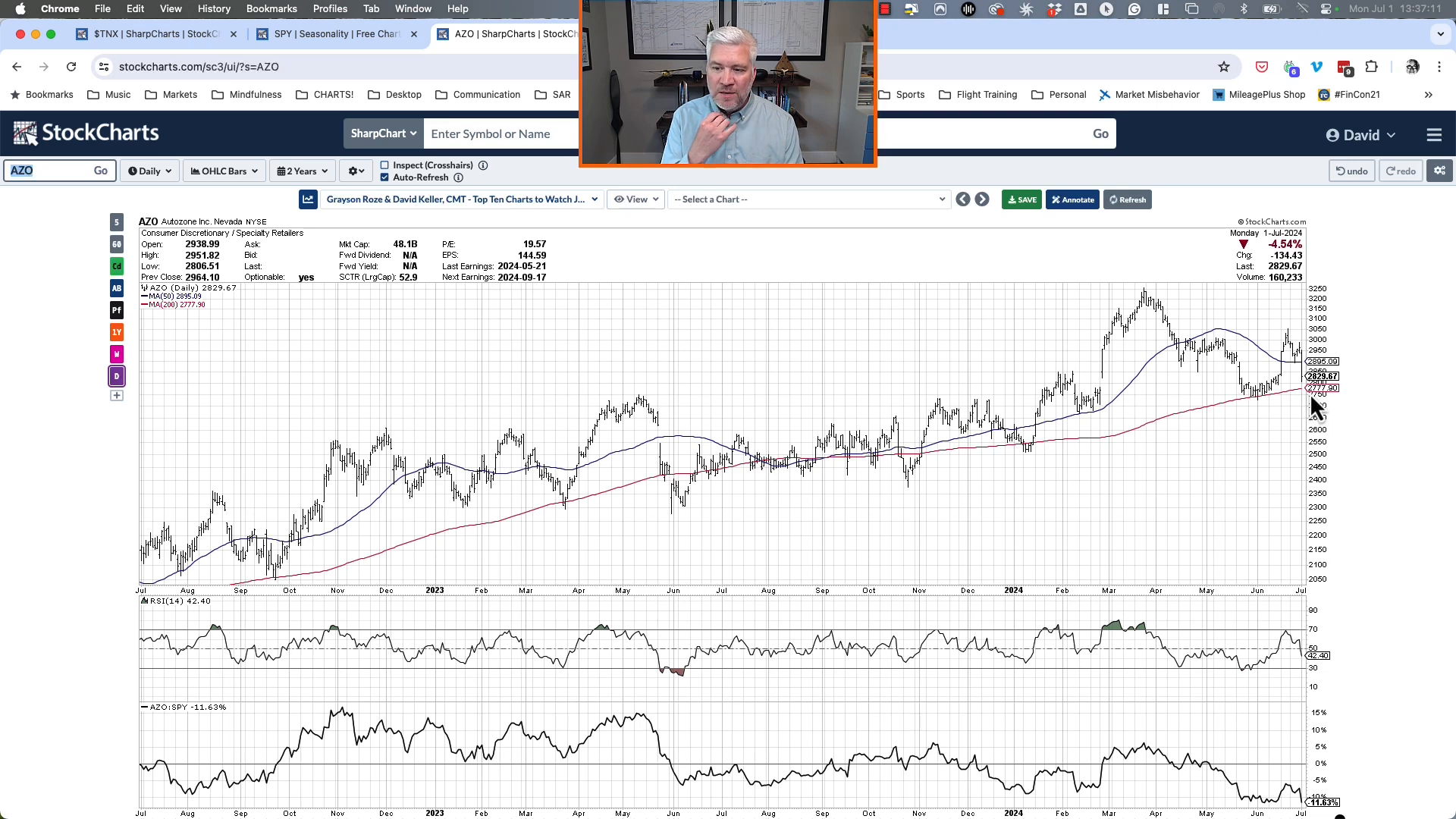

Autozone (AZO)

Autozone, a member of the Auto Parts Group, demonstrated substantial market movements, initially displaying positive momentum in the month of June before encountering weakness towards the end of Q2. The stock experienced a significant drop of approximately 4.12% during the latest session, positioning it as one of the worst performing members of the S&P 500. With the stock approaching the 200-day moving average and the swing low from May, it becomes crucial to closely observe its price behavior for potential insights into future market direction.

These developments in MGM Resorts International and Autozone highlight the dynamic nature of the current market environment, underscoring the importance of vigilant analysis to navigate potential shifts in the economy and stock sectors.

📈 Carnival Corp. (CCL), Tesla (TSLA), Apple (AAPL)

Let's analyze the recent market movements of Carnival Corp. (CCL), Tesla (TSLA), and Apple (AAPL), shedding light on their impact on the economy and stock sectors.

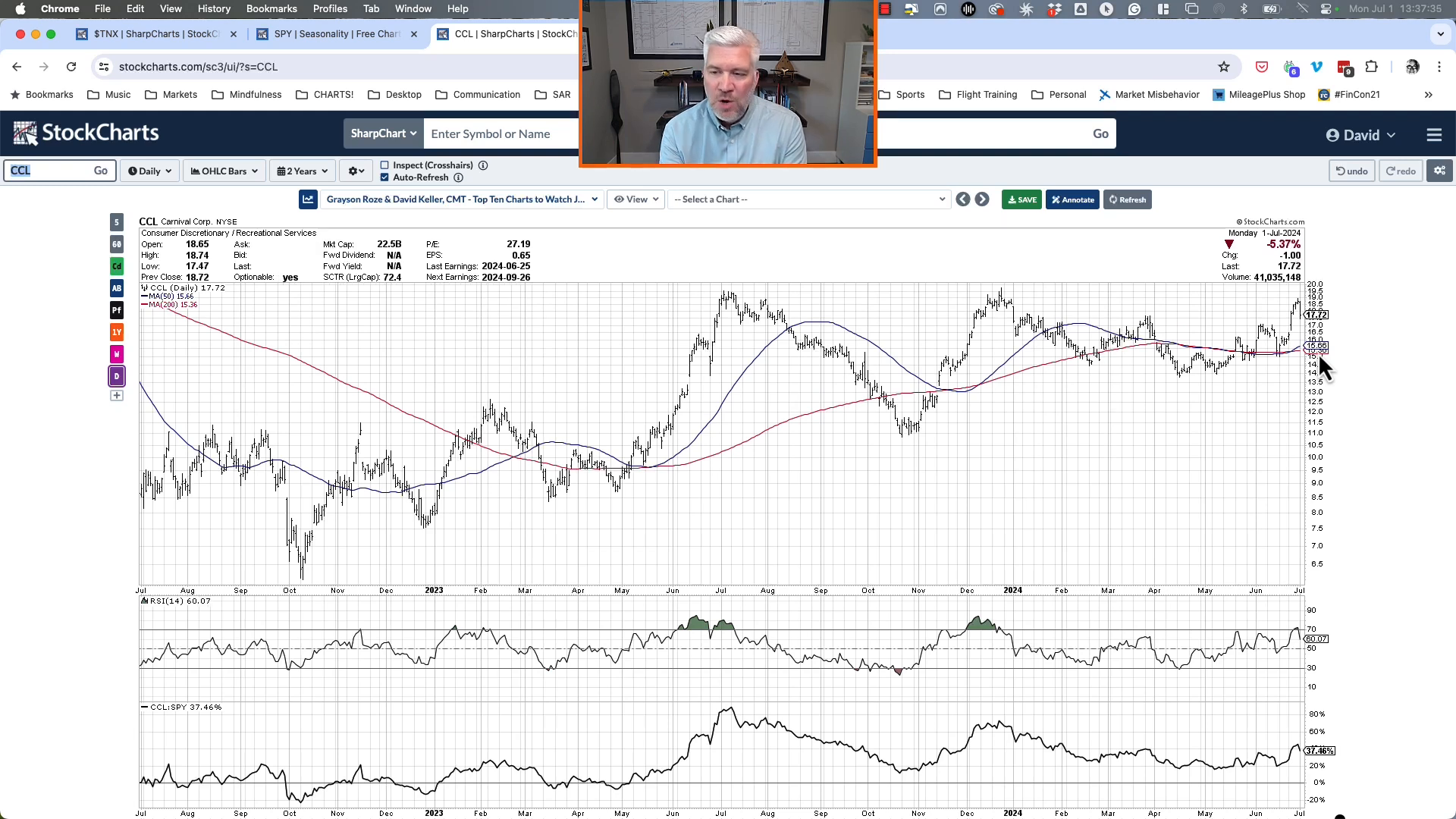

Carnival Corp. (CCL)

Carnival Corp. has encountered a significant downside movement, with a decrease of over 5%. Interestingly, the stock has been testing resistance levels, presenting a potential opportunity for a constructive breakout. However, the recent downturn from the resistance level suggests a stall in the anticipated upside breakout. This trend raises concerns as we enter a traditionally bullish phase in July, indicating a potential risk-off signal for the markets. It's crucial to monitor these developments closely to gauge investor sentiment and market dynamics.

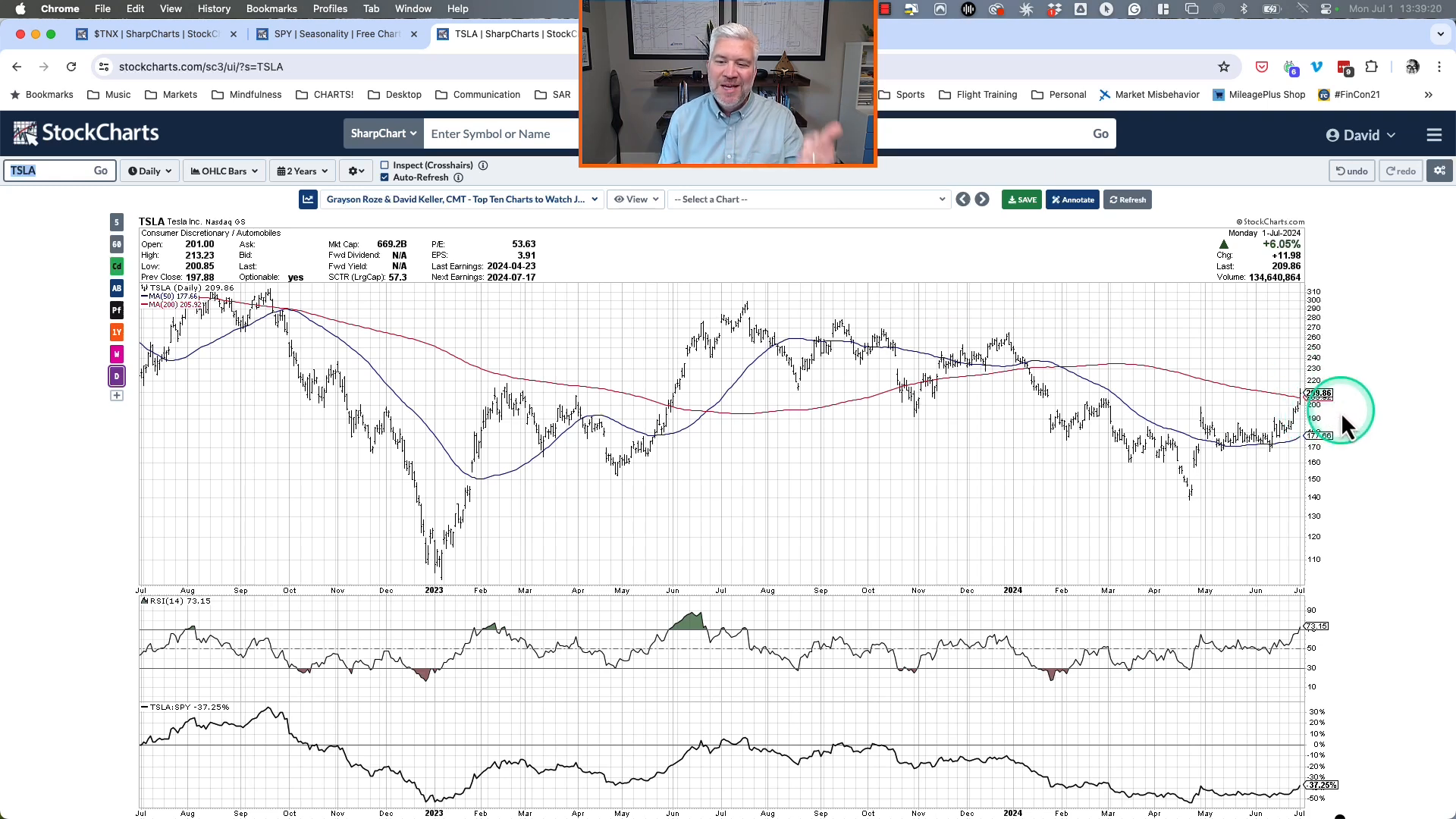

Tesla (TSLA)

Tesla has emerged as one of the top-performing names in the S&P, surpassing the 200-day moving average for the first time since early January. With a notable surge of 6%, the stock has finally surpassed the $200 mark, signifying a crucial breakthrough. The next key consideration is the concept of follow-through, which will determine the sustainability of this upward momentum. Additionally, the stock's ability to attract additional buying interest and test resistance levels in the mid to upper 200s will be a pivotal factor in confirming its upward swing and overall market performance.

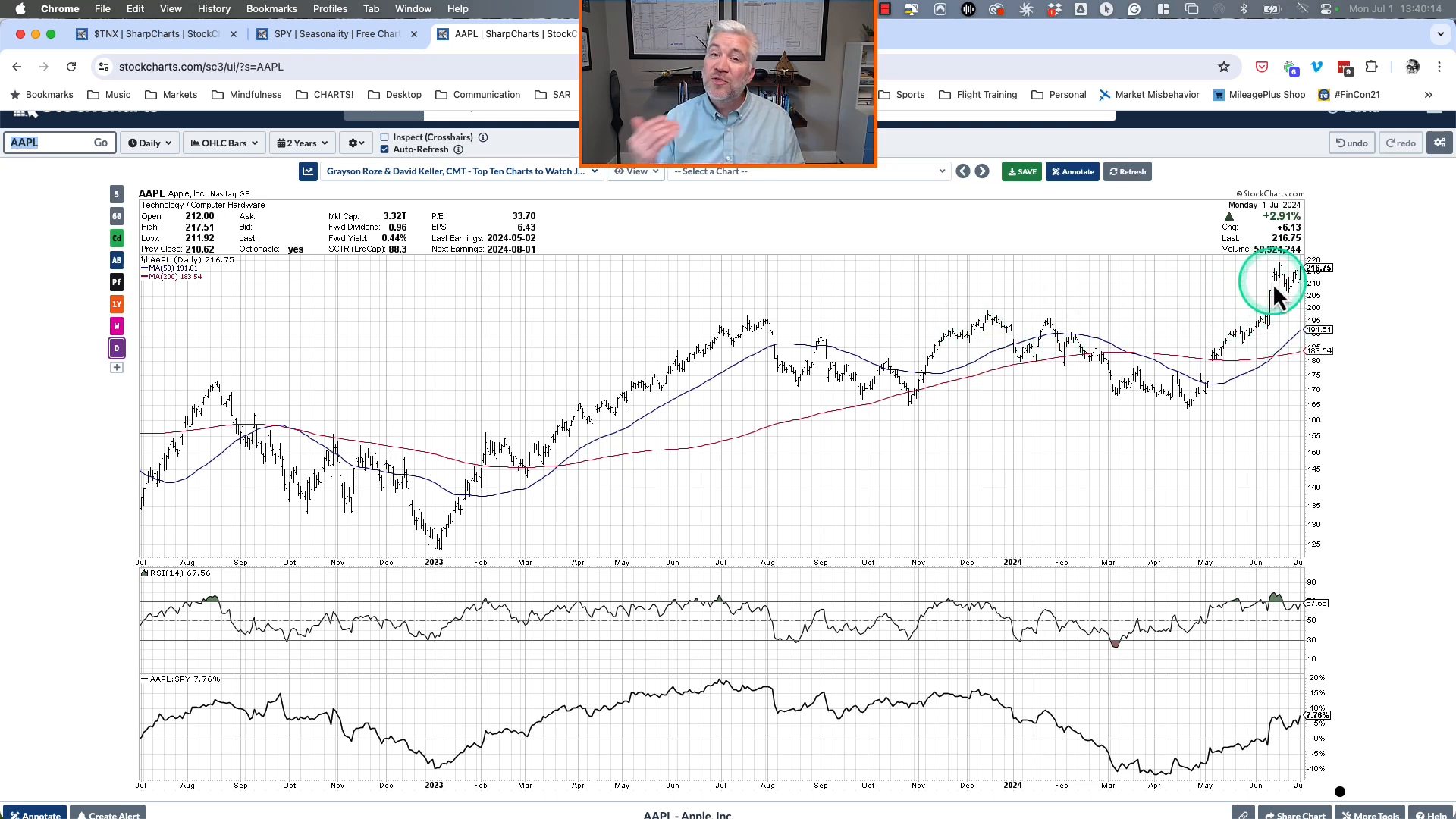

Apple (AAPL)

Apple has exhibited a notable breakout, surpassing resistance around $195 with authority. However, the stock encountered a stall after this breakout, forming a higher low around $206. This rotation back higher presents a promising chart, with a clear natural stop around the $206 level. This higher low serves as a positive indicator for the stock's performance, positioning it as an outperformer in the market. Monitoring the stock's ability to maintain the $206 level will provide valuable insights into its future trajectory and market impact.

These developments in Carnival Corp., Tesla, and Apple underscore the dynamic nature of the current market environment, emphasizing the importance of vigilant analysis to navigate potential shifts in the economy and stock sectors.

📈 CrowdStrike Holdings (CRWD), Goldman Sachs (GS)

Let's delve into the recent market movements of CrowdStrike Holdings (CRWD) and Goldman Sachs (GS), shedding light on their impact on the economy and stock sectors.

CrowdStrike Holdings (CRWD)

CrowdStrike Holdings has displayed a compelling setup, with a potential rotation above the $400 mark. While the stock has shown a natural stop around 370, it's crucial to monitor its movement towards surpassing the 400 level, which would signify a completed rotation. This development presents an opportunity for investors to assess the stock's performance and potential for further upside momentum in the market.

Goldman Sachs (GS)

Goldman Sachs has exhibited a favorable pattern, bouncing off an ascending 50-day moving average. This chart setup indicates the stock's potential for new swing highs, supported by its movement above two upward sloping moving averages. The pullback to the 50-day moving average presents an attractive entry point, with the stock's ability to break above 470 validating an upswing. Monitoring the RSI and its push higher will provide confirmation of a next leg higher for Goldman Sachs, aligning with the current bullish market environment.

These recent market movements in CrowdStrike Holdings and Goldman Sachs highlight the dynamic nature of the current market environment, underscoring the importance of vigilant analysis to navigate potential shifts in the economy and stock sectors.

Made with VideoToBlog

- Get link

- X

- Other Apps

Comments

Post a Comment