Bitcoin Correction: Is the Bottom Already In or More Downside Ahead? 🤔

- Get link

- X

- Other Apps

The cryptocurrency market has been on a rollercoaster ride lately, with Bitcoin experiencing a significant 19% correction. The big question on everyone's mind is whether this correction has already reached its bottom, or if there is more downside ahead. In this blog, we'll dive deep into the potential scenarios and explore the key factors that could shape Bitcoin's near-term trajectory.

Historical Averages and the Current Correction 📊

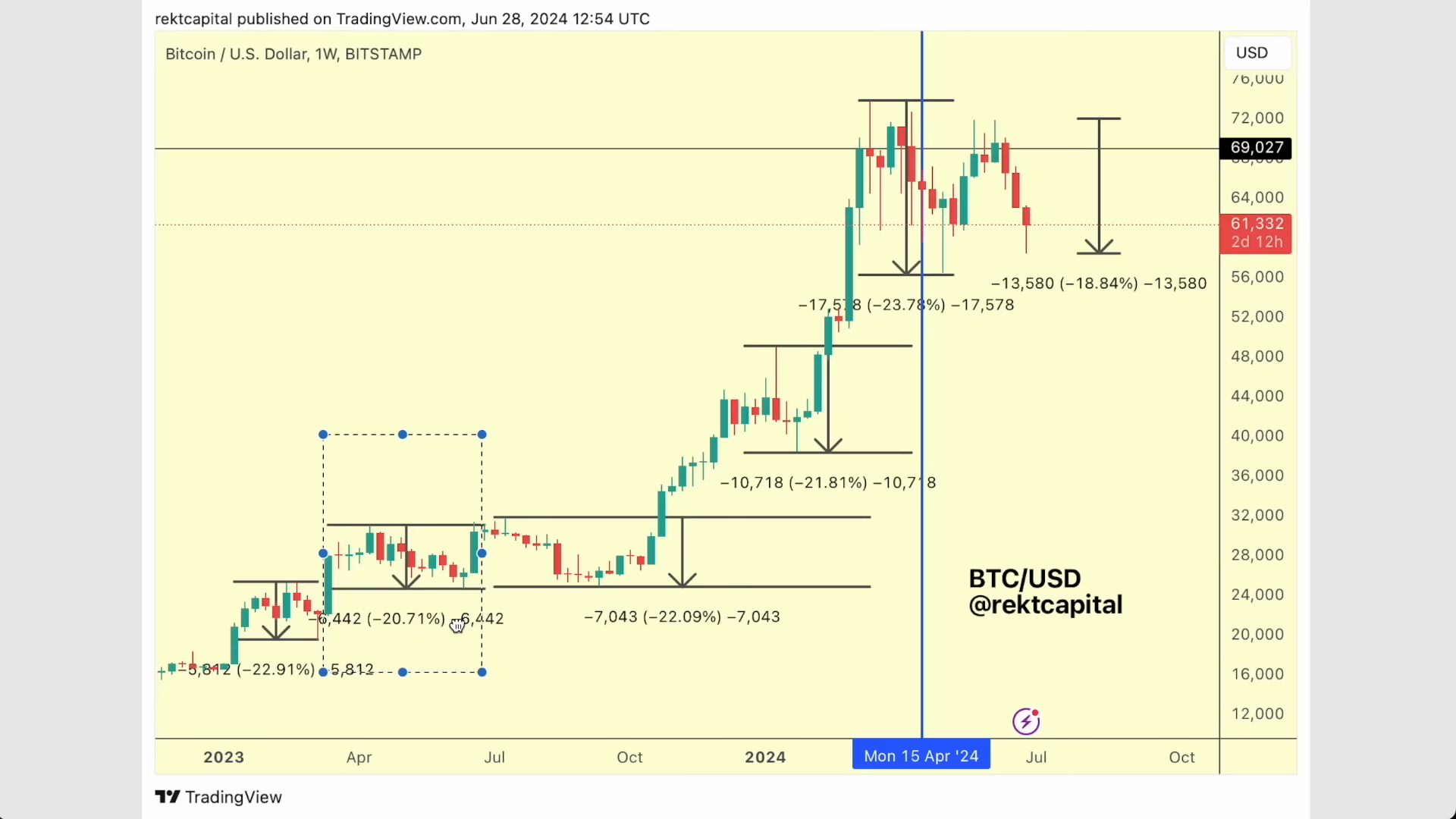

Historically, Bitcoin has experienced an average 22% correction during its market cycles. This time around, the correction has reached 23.8%, slightly deeper than the historical average. However, the good news is that we've already seen a fantastic rebound from the lows, suggesting that the bottom may be in or very close.

One of the key levels to watch is the weekly close above $61,300. This level has acted as a major demand zone in the past, triggering rebounds to the low $70,000s. If we can manage to close the week above this level, it would be a strong signal that the bottom is already in place.

Potential Downside Scenarios 📉

Now, let's consider the possibility of a deeper correction. If we were to see an average 22% pullback from the recent highs, that would take us down to around $56,000, which is interesting as it would coincide with the double bottom of the previous corrective phase. In this scenario, we could see a downside wick to $56,000, followed by a candle body close above $61,300, which would be a healthy and sustainable way to establish a bottom.

Alternatively, if we were to see an even deeper correction, equal to the previous record of 23.8%, that would take us down to around $55,000. While this is a possibility, I don't believe it's likely to happen so soon after the previous record-breaking correction. It would be quite unusual to see two such deep retracements in such a short timeframe.

The Reaccumulation Range and Buying Opportunities 💰

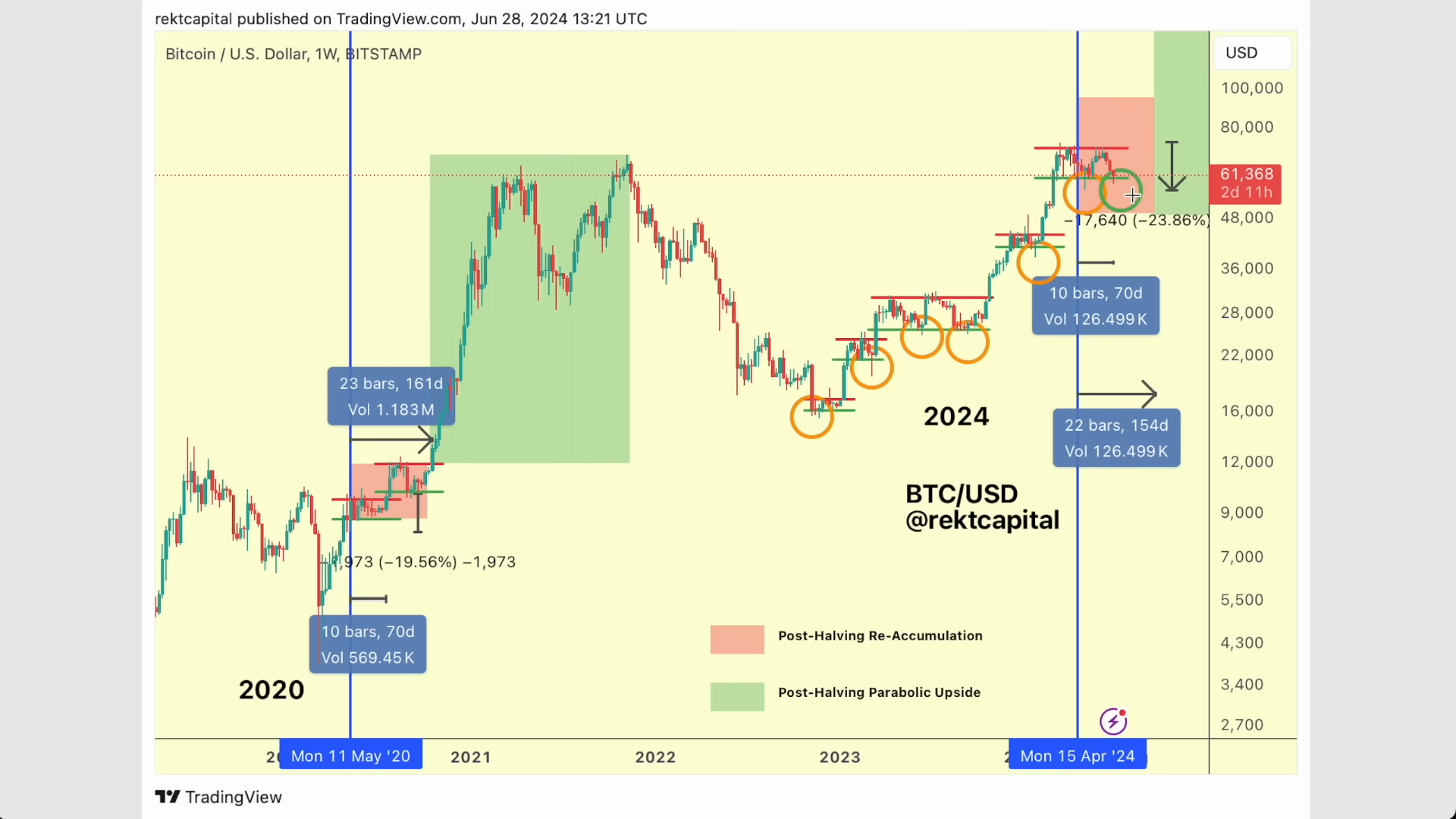

Looking at the bigger picture, this current correction is part of the post-halving reaccumulation range. This is a crucial phase where Bitcoin consolidates and prepares for the next parabolic upside move. The range low support around $56,600 is a key level to watch, and any downside wicks below this level could present excellent buying opportunities.

Historically, we've seen that just a single downside wick below the range low is often enough to garner the necessary buy-side liquidity to fuel a reversal back to the upside. The fact that we've already seen one such downside wick suggests that we may be very close to, if not already at, the bottom of this correction.

Consolidation and the Path Forward 🧭

In terms of the duration of this correction, we're already approaching the historical average of 42 days. The longer a correction lasts, the closer we tend to be to the bottom. Additionally, the formation of a diamond-shaped reversal pattern, with higher lows in both the downside wicks and the candle bodies, is a bullish sign of premium buyer behavior.

While the market may still see some additional consolidation, it's important to keep in mind that we're only about 70 days into the post-halving reaccumulation phase. Historically, this phase lasts around 160 days before the next parabolic upside move. So, an additional 70-90 days of consolidation would be well within the normal range and ultimately beneficial for Bitcoin's long-term health and sustainability.

Conclusion: Patience and Prudent Investing 🏆

In conclusion, the current Bitcoin correction appears to be nearing its end, with the bottom potentially already in place or very close. The combination of historical averages, key support levels, and technical patterns suggest that the downside risk is limited, and the market is positioning for the next phase of the cycle.

As always, it's crucial to approach the cryptocurrency market with patience, discipline, and a long-term mindset. By staying informed and making prudent investment decisions, you can navigate the volatility and position yourself for the potential rewards that lie ahead. Remember, the longer Bitcoin consolidates, the better it is for the overall health of the cycle.

For more cutting-edge insights and expert market commentary on Bitcoin and altcoins, be sure to check out the Rekt Capital Newsletter, take the Free Technical Analysis Course, and explore the comprehensive Rekt Capital Technical Analysis Course. Stay tuned for more videos like this on the Rekt Capital YouTube channel.

Happy trading, and may your investments be Rekt Capital!

Rekt Capital provides unbiased, level-headed market insights to help you make money trading and investing in cryptocurrencies.

Made with VideoToBlog

- Get link

- X

- Other Apps

Comments

Post a Comment