Live Hot Issue: Economy and Business Stocks to Watch for Investors

- Get link

- X

- Other Apps

In this news report, we'll dive into the latest trends and technical analysis of three key stocks - Microsoft (MSFT), Roku (ROKU), and Raytheon (RTX) - that are capturing the attention of the economy and business world. Our expert analysts will provide insights on the opportunities and challenges facing these live, hot issue stocks.

Table of Contents

- 💻 Microsoft (MSFT): A Dominant Player in the AI Sector

- 📈 Microsoft's Bullish Technical Patterns Across Multiple Timeframes

- 📺 Roku (ROKU): Navigating Sector Competition and Volatility

- 📺 Roku's Price Action: Establishing a New Area of Value

- 📉 Raytheon (RTX): Weathering Short-Term Weakness, Eyeing Long-Term Potential

- 📊 Raytheon's Price Activity and Trend Analysis

💻 Microsoft (MSFT): A Dominant Player in the AI Sector

Microsoft (MSFT) continues to be a dominant force in the AI sector, positioning itself as a leader in technological innovation and advancement. Despite recent legal challenges and market volatility, Microsoft remains a key player in the AI industry, offering substantial opportunities for investors.

The Strength of Microsoft in the AI Sector

Microsoft's position as a leader in the AI sector is evident through its consistent efforts in technological advancements and strategic partnerships. The company's commitment to innovation and its robust AI capabilities solidify its dominant position in the market.

Potential for Profitable Investments

Investors have the opportunity to capitalize on Microsoft's strong presence in the AI sector. The company's resilience and continued growth in the face of challenges make it an appealing investment option, offering the potential for significant returns.

Opportunities Amid Market Volatility

In the current market environment, characterized by fluctuations and uncertainties, Microsoft presents a stable and promising investment opportunity. Its resilience and potential for growth in the AI sector make it an attractive option for investors seeking long-term profitability.

📈 Microsoft's Bullish Technical Patterns Across Multiple Timeframes

As I delve into Microsoft's technical analysis, it's evident that the stock is exhibiting bullish patterns across various timeframes, bolstering its position in the market. These patterns serve as a strong foundation for the company's fundamentals, as highlighted by its resilience and upward trajectory.

Short-Term Rally: A Promising Upswing

The recent price activity showcases a notable upward trend, with the stock surging from the lows of around 443-444 to a significant high of 456. This short-term rally reflects the stock's resilience and potential for growth in the current market environment.

Midterm and Long-Term Trends: Sustained Growth

Upon analyzing the 30-minute and 60-minute candle charts, it becomes evident that Microsoft has sustained its growth trajectory over the midterm and long-term. The well-defined areas of consolidation and the high conviction trade further reinforce the stock's bullish momentum, signaling a favorable outlook for potential investors.

Long-Term Trend: Continual Upsurge

Microsoft's longer-term trend showcases a consistent upward movement, solidifying its position as a bullish contender in the market. The stock's ability to maintain a well-defined trend higher, even amidst market fluctuations, signifies its enduring strength and potential for continued growth.

📺 Roku (ROKU): Navigating Sector Competition and Volatility

When it comes to Roku, it's essential to acknowledge the increased competition in the streaming sector, with players like Apple, Disney, and others vying for market share. However, Roku stands out as a distinct entity, focusing on strategic acquisitions and maintaining leadership in content acquisition. Despite recent market challenges and being undervalued, there's a strong potential for Roku's stock to grow by more than 10% within a 12-month timeframe, making it an intriguing investment opportunity.

Roku's Unique Position in a Competitive Landscape

Roku's differentiation from direct competition with major players like Apple and Disney lies in its strategic focus on content acquisition and its pursuit of strategic acquisitions. This unique positioning allows Roku to navigate the competitive landscape and presents opportunities for growth despite sector-wide challenges.

Potential for Contrarian Growth and Revenue Consolidation

Considering the historical performance of Roku's stock amidst sector downturns, there's potential for it to emerge as a contrarian within the sector, showing upward movement in a relatively short timeframe. Additionally, the company's revenue prospects and industry consolidation position Roku as a promising contender, although patience may be required for long-term gains.

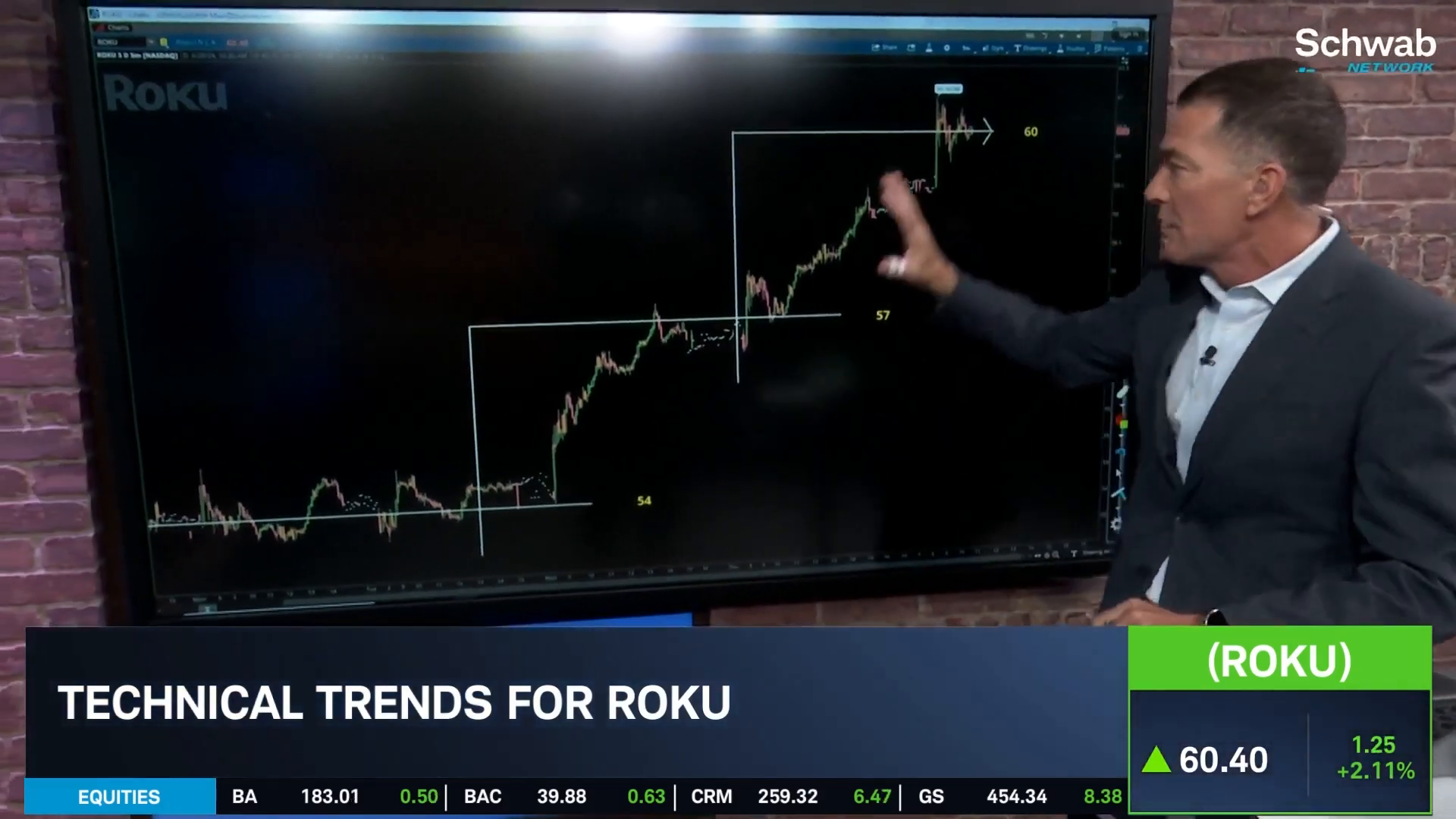

📺 Roku's Price Action: Establishing a New Area of Value

As I analyze Roku's recent price action, it's evident that the stock is in the process of establishing a new area of value, indicating a potential upward trend. The current market activity reflects a high conviction move, with the stock exhibiting a staircase-like pattern, signaling positive momentum for investors.

Formation of New Area of Value

Within the recent market dynamics, Roku has shown signs of seeking value higher, with a notable balance around the $57 level. The subsequent move towards establishing a new area of value around $60 aligns with the bullish sentiment among investors, highlighting the stock's potential for upward growth.

Potential for Upside Momentum

Despite the challenges of communicating a clear trend, Roku's price action presents the possibility of upside momentum within its current range. The stock's resilience and the formation of a well-defined pattern indicate potential room for growth, offering an opportunity for investors to capitalize on the upward potential.

📉 Raytheon (RTX): Weathering Short-Term Weakness, Eyeing Long-Term Potential

Despite facing short-term weakness, Raytheon (RTX) exhibits resilience and potential for long-term growth. The stock's technical trends and market dynamics present both challenges and opportunities for investors, making it essential to analyze the broader context of its performance.

Short-Term Volatility: Navigating Market Challenges

Raytheon (RTX) is currently experiencing short-term volatility, reflected in its price activity and consolidation patterns. The market environment, characterized by fluctuations and uncertainties, poses challenges for the stock's immediate trajectory, requiring a strategic approach from investors.

Long-Term Growth Potential: Enduring Strength and Resilience

Amidst the short-term fluctuations, Raytheon (RTX) maintains its position as a bullish contender with a consistent upward movement in the longer term. The stock's ability to weather market pressures and sustain a well-defined growth trend signifies its enduring strength and potential for continued growth.

Technical Analysis and Price Development

Examining the technical analysis and price development of Raytheon (RTX) provides insights into its current market position. Analyzing the stock's consolidation phases, balance levels, and potential breach points offers valuable indicators for investors to navigate the short-term challenges and capitalize on long-term opportunities.

For more in-depth insights into the market and financial news, I highly recommend tuning in to the Schwab Network. It offers comprehensive coverage of market trends, analysis, and education, empowering every investor and trader to make informed decisions in the dynamic world of stocks and finance.

📊 Raytheon's Price Activity and Trend Analysis

As I delve into the analysis of Raytheon's (RTX) price activity and trend, it's essential to understand the dynamics shaping its market performance. Raytheon's stock presents a blend of short-term volatility and long-term growth potential, offering a nuanced landscape for investors to navigate within the stock market.

Short-Term Volatility and Resilience

Raytheon (RTX) currently experiences short-term volatility, reflecting fluctuations in its price activity and consolidation patterns. Despite these challenges, the stock exhibits resilience, indicating its ability to withstand market pressures and navigate through uncertainties.

Long-Term Growth and Technical Analysis

Examining Raytheon's long-term growth potential provides valuable insights into its enduring strength and market positioning. Analyzing the stock's consolidation phases, balance levels, and potential breach points offers investors an opportunity to capitalize on the stock's long-term growth trajectory amidst short-term fluctuations.

Price Development and Market Dynamics

An in-depth analysis of Raytheon's price development and market dynamics unveils crucial indicators for investors to make informed decisions. Understanding the stock's price activity and trend patterns allows investors to strategically position themselves within the dynamic landscape of the stock market, aligning with the broader context of Raytheon's performance.

Made with VideoToBlog

- Get link

- X

- Other Apps

Comments

Post a Comment